In today’s fast-paced financial landscape, credit lending faces a critical challenge. With traditional credit assessment methods struggling to keep up with the digitization of financial processes and changing consumer behaviors, lenders are in need of a comprehensive and adaptable credit scoring solution.

Introducing V3, the next generation Consumer Bureau Score – the innovative answer to the challenges of modern credit underwriting. With V3, you can now confidently navigate the dynamic credit landscape, seizing untapped opportunities and making informed decisions.

What is Consumer Bureau Score V3?

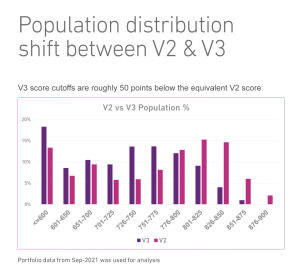

V3 is an improved version of the Consumer Bureau Score and will replace the existing V2 score. The new V3 scores are more powerful than the current Consumer Bureau Score.

How can Consumer Bureau Score V3 help?

With advancements in digital infrastructure and zealous government policies, India is geared to make significant progress. Financial institutions can enhance their credit portfolios by tapping into unexplored sectors which presents exciting underwriting opportunities. Thanks to its adaptiveness and scalability, the Consumer Bureau Score V3 helps overcome challenges as well as pitfalls that come along with this development.

Key features

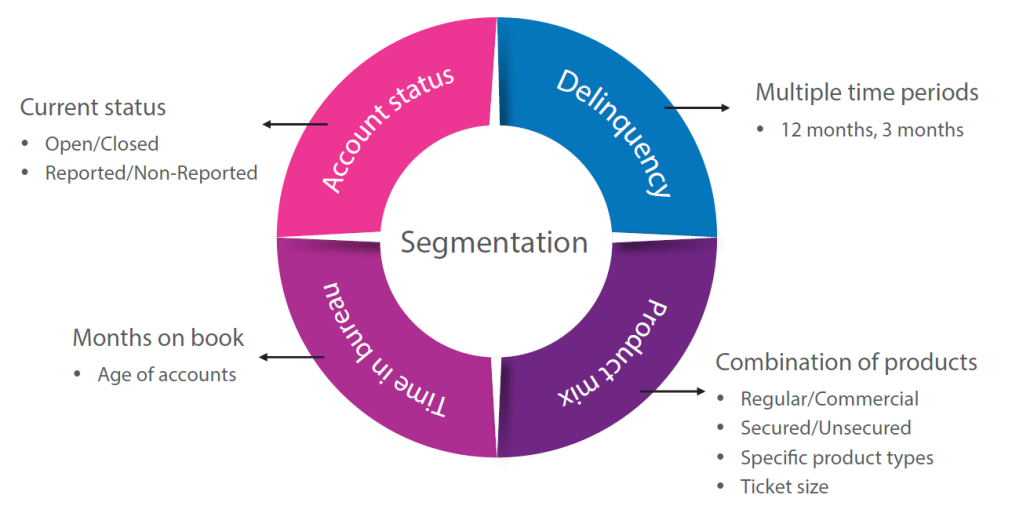

Consumer Centric Segmentation

Scoring segments and variables cover new customers and market behaviours such as BNPL and Affordable Housing, to name a few:

- More granular and relevant to the evolving customer profile

- Use of customer product holding, over and above delinquency status provides for more contextual segmentation based on customer product preferences

- Special treatment to segments, like thin on bureau and agri, among others

Segmentation scheme

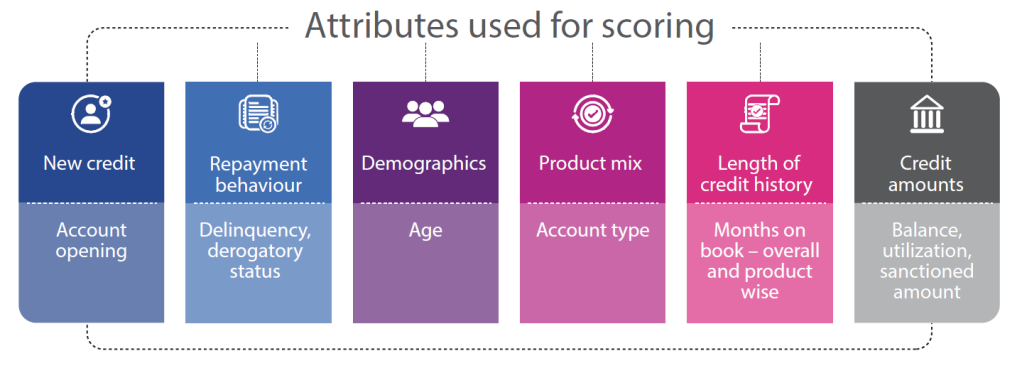

Feature Engineering

- The use of more recent data and trended variables along with multiple intuitive attributes, such as pre-payments and positive closures ensure, stable and robust score performance

- Over 7,000 bureau-based attributes exclusive to Experian leveraged in Score development

- Scorecard algorithm finalised after multiple iterations using enriched inputs and rigorous fine-tuning of attributes

Robust Performance

- Performance of the score is monitored at periodic intervals to ensure that it continues to perform well

- Recalibration is carried out if deterioration is observed in any of the segments

How can you benefit from Consumer Bureau Score V3?

The following aspects that are factored into the Consumer Bureau Score V3 make it the perfect index to reinforce credit decisioning processes:

- Evolving fnancial products, like small-ticket loans, digital loan products, Buy Now Pay Later (BNPL) loans, payday loans and many more

- Intuitive consumer credit behaviours, like prepayment and positive closures

- Evolving macroeconomic, microeconomic and industry – specifc trends

- Improve effciency in your underwriting process

- Efectively monitor portfolios and make informed decisions